The Iowa Legislature sent a bill to Governor Reynolds that creates a 3.9% flat tax in four years

Waterloo, IA – According to the state officials, the new bill also eliminates taxes on retirement income.

It also lowers taxes for corporations at an estimated cost of nearly $2 billion when fully implemented in a state with an annual $8 billion budget.

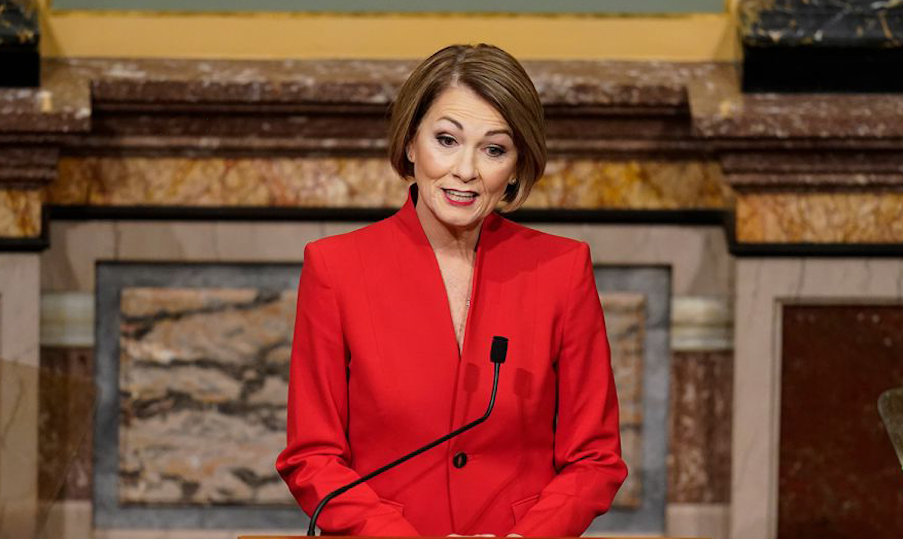

Our State will join 10 other states with a flat tax when Gov. Kim Reynolds signs the new bill.

Gov. Kim Reynolds released the following statement:

“When I took office, Iowa had the sixth highest individual income tax rate in the nation at 8.98%. I believed Iowans deserved better. Since then, I’ve worked with the Legislature across multiple sessions to make transformative changes to our tax code, let Iowans keep more of their hard-earned money, and make our state more competitive.

Today’s bipartisan, consensus bill shrinks individual income tax rates to a flat and fair 3.9%, the fourth lowest in the nation. It eliminates state income tax on retirement income, overhauls our corporate tax system, and accelerates the incredible momentum we’ve built since 2018.

There’s never been a better time in Iowa for bold, sustainable tax reform. This bill rewards work, takes care of our farmers, and supports our retirees, all while protecting key state priorities. Iowans will reinvest these dollars in our economy, communities will prosper, and families will rest a little easier. Once again, we’re putting our faith in Iowans, and they won’t let us down.”